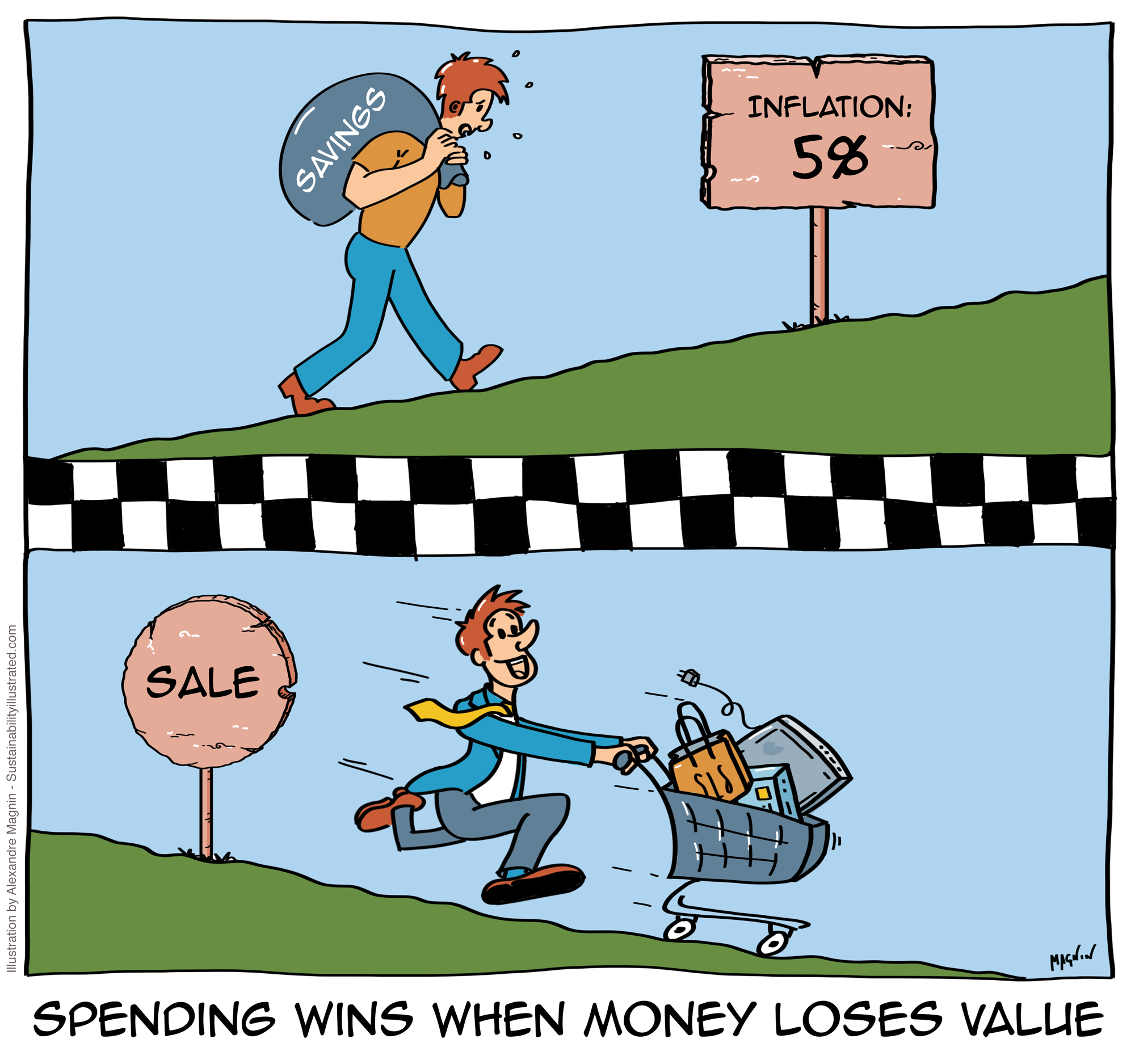

The lack of options for savings creates an incentive for spending when inflation is around.

Imagine two runners in a race: one trudges uphill, lugging a heavy bag with his “Savings,” while the other glides downhill, pushing a shiny shopping cart past “Sale” signs. This is the essence of this cartoon, Savings vs. Spending Race, which captures a key economic truth: when inflation erodes money’s value, spending often feels like the faster track. Inflation, the steady rise in prices over time, means your money buys less tomorrow than it does today. For example, if a loaf of bread costs $3 today but $3.30 next year due to a 10% inflation rate, waiting to spend reduces your purchasing power. This dynamic creates a powerful incentive to spend now rather than save, as saving money in a low-interest environment often yields returns that lag behind inflation. The Bank of England notes that inflation, when above target levels like 2%, can significantly impact consumer behaviour, pushing people toward consumption to avoid higher future costs Illustrating Inflation — Google Arts & Culture.Our cartoon illustrates this vividly. The “Savings” runner struggles against signs reading “Inflation 5%”, symbolizing how inflation makes saving feel like an uphill battle. Meanwhile, the “Spending” runner cruises downhill, tempted by deals and the urgency to buy before prices climb. Economic policies, like low interest rates, further tilt the track, making borrowing and spending more appealing than saving.

This race reflects a broader reality: inflation nudges us to consume now, as holding cash feels like watching it shrink. By visualizing this economic tug-of-war, the cartoon underscores why spending often wins when money loses value over time, encouraging us to rethink how we manage our finances in an inflationary world.

Citation: Illustrating Inflation — Google Arts & Culture

Find all our sustainability cartoons here and all our engaging whiteboard videos to learn about sustainability here.